The recent sharp rises in energy prices had threatened to bring electric car charging costs closer than ever to the price of petrol and diesel refuelling.

However, this worry was somewhat alleviated when the government announced its Energy Price Guarantee, capping energy prices at 34p per kilowatt hour (34p/kWh) – rather than doubling to the previously announced figure of 52p/kWh.

Nonetheless, the cost of EV home charging is likely to increase by as much as 20% this winter – while already, public electric car charging stations cost up to 42% more now than they did just four months ago.

What does that mean for electric car running costs?

Fleet News reports that the typical charging cost of electric cars at home will go from around £7 for each 100 miles of charge added to the battery, to £8.50. That’s based on a vehicle that travels around four miles per kWh.

When you consider that the average range of EVs is now reported to be around 260 miles, that means a total 0-100% charge cost of around £22. That’s significantly cheaper than the RAC Foundation places the average cost of filling up a petrol (£89.91) or diesel (£99.24) tank at the time of writing.

Of course, while the prices for charging at-home (or indeed, at your fleet’s home depot) are more affordable, fleet drivers – particularly ones who make frequent long journeys – are more likely than your average commuter to use roadside public charging networks. And those networks are experiencing sharp increases.

The most extreme example of these price hikes comes from charge network provider Osprey, which recently increased its prices by 35% from 66p/kWh to an unheard-of £1/kWh in response to the energy crisis.

While Osprey may be an outlier, it’s clear that at-home charging will be by far the most cost-effective way to charge an EV for the foreseeable future. Business fleets should therefore make smart use of tools like Zap-Map by planning ahead on long journeys to locate and use the most cost-effective charge points, helping to lower fuel expenditure on a consistent basis.

The expenses impact on fleets and fleet drivers

One thing the government has still to address is the advisory electricity rate (AER), which is the pence-per-mile (ppm) rate that the government recommends fleets use to reimburse drivers for charging costs of electric cars used for business.

Fleet News reports that drivers whose vehicle manages three miles per kWh are likely to pay around 11ppm – six pence more for each mile travelled than the government’s sanctioned amount.

Understandably, being able to claim back less than half of their business fuel expenses is likely to impact drivers negatively, and could cause some resentment. It’s a cost that could run into hundreds, if not thousands, of pounds across a working year.

If you run a business fleet, one answer to appease drivers could be to set your own reimbursement rate more in line with current energy prices – something the majority of fleet owners feel should be around 15ppm.

However, as EV charging specialist Mina warns, fleets should do this with caution, and be willing to substantiate to HMRC that you’re paying the actual cost of the electricity being used. Get this wrong and you’ll at the very least incur benefit in kind charges on the reimbursement, but could even end up with the taxman taking a closer look at your business.

Making electric car charging costs more manageable

For the majority of lease hires and company car drivers, home charging will be the main method of filling up the battery to get from A to B. Thankfully, there are certain energy tariffs that can help them get the most for their money.

With a compatible EV charger installed at your property (something that renters, flat owners and landlords can get a significant discount on), an EV tariff could help you make a quite sizeable saving when charging your electric vehicle between certain times – most notably overnight.

Indeed, Fleet News suggests that the Intelligent tariff from Octopus Energy, which has an off-peak rate of 7.5p/kWh, could lead to a 100-mile charge cost of just £1.80. Considering the average UK driver travels around 6,800 miles annually, that makes for a charging cost as low as £127.50, based on a vehicle travelling at least four miles per kWh. That’s four times less than the new 34p/kWh price cap.

Whichever way you look at it, then, even with the electricity price hike, EVs are still the smart choice when it comes to business fleets saving fuel money.

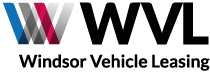

Need a new EV on lease hire?

You’re in the right place. Even in a tricky climate for vehicle availability, our team of industry experts have the means to find you an electric vehicle that will fit your needs, ensuring you can enjoy the benefits of lower electric car running costs vs petrol and diesel vehicles.

To find out more about EVs check out the blogs below. To see how we can help you find a suitable EV, take a look at our post ‘The WVL Leasing Difference’ or get in touch with us to find out more.